The video includes the following:

- Basic preparation of an Individual Tax Return

- Activating Financial Picture

- Individual Tax Return with “Foreign Income”

- “Suspending” the form

- To learn more about how to fill this tax return, please review the detailed ATO instruction set. - Individual Tax Return Instructions 2025

See attached spreadsheet example for Sole Trade Comparatives.

Related Article:

Using LodgeiT Smart Excel Utility to Create Financial Reports for a Sole Trader

The Basics

To work with a individual tax return, first ensure that all the necessary information about the company/client has been added to LodgeiT via "Settings"If you fail to do this, you will encounter a range of difficulties.

Then you can proceed to adding a form-

Select Forms

Now, to the right of the screen, Select "+ Add Form"

Click the form that you need.

Note: If Individual Tax Return (ITR) is not available from the option, check your Setting via Gear Leaver and make sure that "Practice Type" is "Tax Agent". Individual Tax Return (ITR) is for Tax Agent use only.

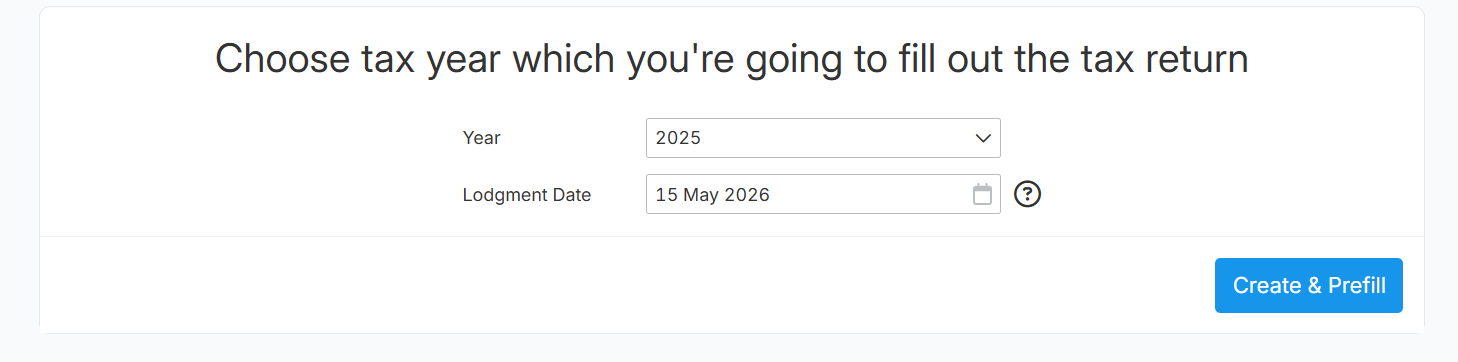

Select Year.

"Lodgement Date" is automatic date from ATO, but you can also manage to change it if necessary.

Click "Skip this Step" or "Continue"

Related guide: Import Financials

Activate the relevant sections that you need to work on, and select "Continue"

Once you've worked in the form, you may need to turn-on certain reporting sections. You can do so via clicking the 4 little squares/manage sections

Check Form status via "Dashboard" . Click here to learn more about Form Sequence

Note: LodgeiT System is an SBR System with SBR dependencies. (LodgeiT uses SBR validation & prefill functions)

Checkout some of our Help guide on:

Form Workflow Sequence and E-signature

Note: If you have no accounting software, you can use our excel template and import it directly to Lodgeit. Learn more